Get ahead of the payday to get paid

Do you need financing? The Activehours studio offers us an affordable app that allows us to receive mini-loans of up to $100 for each day we work.

A new financial system created by the community

Economic ravages have made financing systems the order of the day. However, taking out a loan or credit card carries high interest rates and serious problems of defaulting. Earnin has emerged as an alternative economic financing tool.

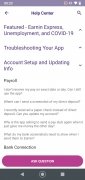

This app is supported by a community of users who build the service in a collaborative way. Specifically, this platform offers the following services:

- Request mini loans between collections (up to 500 dollars per payment period).

- Save money by tipping ourselves.

- Explore options to save on medical expenses.

- Avoid unnecessary overdraft fees.

- Earn cash for our purchases.

- System of notifications when we are running out of money in the bank.

Six financial tools in one simple and easy to use application.

The app records our location every time we go to our workplace to check the hours we have worked. Plus, we have the option to enter additional tips to help cover another user's.

A mini-loan may not be a long-term solution, but if we need money at specific times it can get us out of a jam. For example, if we have to get gas to go to the office and are short on cash. All we have to do is download the APK file, register and apply for the loan to cover our emergency.

Requirements and additional information:

- Minimum operating system requirements: Android 7.0.

Almudena Galán

Almudena Galán

With a degree in Law and Journalism, I specialized in criminology and cultural journalism. Mobile apps, especially Android apps, are one of my great passions. I have been testing dozens of apps every day for over six years now, discovering all...

Laura Stutt